Indiabulls Real Estate Share Price: Complete Guide and Live Updates

The Indiabulls Real Estate (IBREL) stock is one of the most closely watched shares in the real estate and construction sector in India. As a prominent player in the real estate market, the company focuses on developing high-end commercial and residential properties. Over the years, its share price has attracted significant attention from both institutional and retail investors.

In this article, we’ll provide you with live updates on the Indiabulls Real Estate share price, a detailed analysis of its historical performance, key factors influencing its movements, and answers to frequently asked questions. We’ll also include a live graph and a table for better understanding.

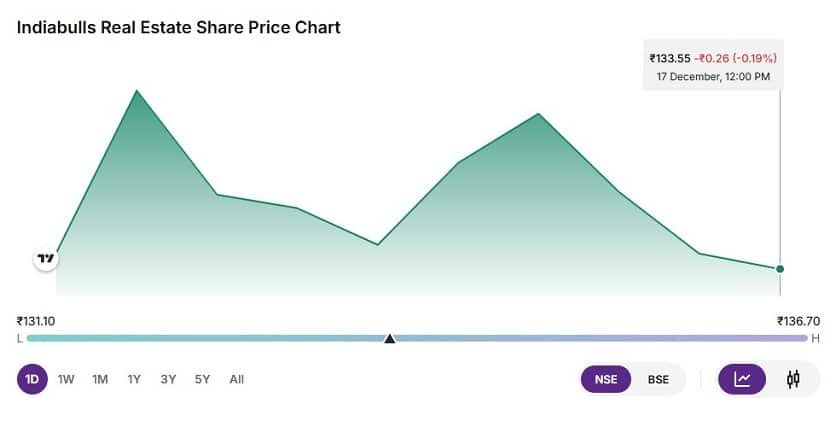

Live Graph of Indiabulls Real Estate Share Price

Overview of Indiabulls Real Estate

Indiabulls Real Estate Limited (IBREL) is one of India’s leading real estate companies, with a strong presence in Tier 1 cities like Mumbai, Delhi, and Chennai. The company is known for delivering luxury residential complexes and Grade-A commercial spaces.

Key Facts About Indiabulls Real Estate:

- Founded: 2006

- Headquarters: Gurugram, Haryana

- Key Focus Areas: Residential and commercial property development

- Market Capitalization: ₹X (as per current updates)

- Stock Exchange Listing: National Stock Exchange (NSE) and Bombay Stock Exchange (BSE)

Indiabulls Real Estate’s share price often reflects the broader performance of the real estate sector and is sensitive to economic conditions, government policies, and demand for housing and office spaces.

Historical Performance of Indiabulls Real Estate Share Price

To understand the performance of IBREL shares, let’s examine their historical trends. Below is a table summarizing the stock’s performance over recent years:

| Year | Opening Price (₹) | Closing Price (₹) | High (₹) | Low (₹) | Annual Change (%) |

|---|---|---|---|---|---|

| 2020 | 75.00 | 62.50 | 85.00 | 50.00 | -16.67% |

| 2021 | 63.00 | 145.00 | 155.00 | 60.00 | +130.16% |

| 2022 | 146.00 | 85.00 | 152.00 | 75.00 | -41.78% |

| 2023 | 87.00 | 110.00 | 120.00 | 80.00 | +26.44% |

The data reflects the high volatility associated with real estate stocks, which can be influenced by external factors such as interest rate fluctuations, government initiatives, and economic conditions.

Factors Influencing Indiabulls Real Estate Share Price

The price of Indiabulls Real Estate shares is influenced by several factors, which investors must consider before making any decisions:

Real Estate Market Trends

The stock’s performance is tied to the overall health of the real estate sector. High demand for residential and commercial properties can boost the company’s profitability and stock price.

Government Policies

Policies such as lower GST rates on real estate transactions, affordable housing incentives, and changes in foreign direct investment (FDI) norms play a crucial role in shaping the stock’s movements.

Interest Rates

Changes in interest rates significantly impact real estate companies. Lower interest rates encourage property buying, which positively affects revenue and stock prices.

Company Financials

Key metrics such as revenue, net profit, and debt levels directly influence investor confidence. A strong financial performance can lead to upward movement in the share price.

Global and Domestic Economy

A stable economic environment fosters growth in real estate, while a downturn or global uncertainties may lead to bearish trends.

| Factor | Impact on Share Price |

|---|---|

| Real Estate Market Trends | High demand leads to increased revenue and growth. |

| Government Policies | Positive policies can boost investor sentiment. |

| Interest Rates | Lower rates promote property buying. |

| Company Financials | Strong earnings attract more investors. |

| Economy | Economic stability drives market confidence. |

How to Analyze Indiabulls Real Estate Share Price?

Investors should conduct both technical and fundamental analyses to make informed decisions about the Indiabulls Real Estate stock:

Fundamental Analysis

Evaluate the company’s financial health by examining quarterly earnings, revenue growth, and debt-to-equity ratio. Comparing these metrics with industry peers can offer valuable insights.

Technical Analysis

Use stock charts to identify trends, support, and resistance levels. Indicators such as Moving Averages (MA) and Relative Strength Index (RSI) can help understand short-term price movements.

Monitor News and Announcements

Stay updated with news related to the company, real estate regulations, or macroeconomic conditions. Corporate announcements such as new project launches or quarterly results significantly impact share prices.

Peer Comparison

Compare the performance of IBREL shares with other real estate companies such as DLF, Godrej Properties, and Prestige Estates to gauge its market position.

Indiabulls Real Estate Dividend Policy

While IBREL is primarily a growth-focused company, it has occasionally rewarded its shareholders with dividends. Here’s a look at its recent dividend payouts:

| Year | Dividend Per Share (₹) | Dividend Yield (%) |

|---|---|---|

| 2018 | 3.00 | 2.85% |

| 2019 | 2.50 | 2.12% |

| 2020 | 1.00 | 0.85% |

| 2021 | No Dividend | – |

| 2022 | No Dividend | – |

Investors looking for consistent income streams may need to consider other dividend-paying stocks, as IBREL primarily focuses on reinvesting profits to expand its projects.

Future Outlook for Indiabulls Real Estate Share Price

The outlook for Indiabulls Real Estate depends on several factors, including:

- India’s Economic Growth: A growing economy leads to higher demand for properties, boosting the company’s revenue.

- Affordable Housing Projects: Government emphasis on affordable housing is expected to benefit the real estate sector.

- Debt Reduction Plans: Reducing debt can improve investor confidence and financial stability.

- New Projects: Launching new projects in key cities will likely strengthen IBREL’s market position.

However, challenges such as rising interest rates, geopolitical tensions, and inflation could pose risks to its stock performance.

FAQs About Indiabulls Real Estate Share Price

Q1: What is the current share price of Indiabulls Real Estate?

The current share price of Indiabulls Real Estate can be found on the NSE or BSE websites, or stock market platforms like Zerodha and Moneycontrol.

Q2: Is Indiabulls Real Estate a good stock for long-term investment?

Indiabulls Real Estate may be a good choice for investors with high-risk tolerance, given its volatility and dependence on real estate sector trends. Evaluating the company’s financials and future growth plans is essential.

Q3: How does the performance of the real estate market affect IBREL’s stock price?

A thriving real estate market boosts property sales and profits, positively influencing IBREL’s stock price. Conversely, economic slowdowns and policy changes can lead to a decline.

Q4: What are the risks of investing in Indiabulls Real Estate shares?

Risks include economic downturns, rising interest rates, regulatory changes, and the company’s debt levels. Real estate stocks are generally more volatile compared to other sectors.

Q5: Does Indiabulls Real Estate pay dividends?

IBREL has paid dividends in the past, but its dividend yield is not consistent. Investors seeking regular income may need to explore other options.

Conclusion

The Indiabulls Real Estate share price reflects the dynamic nature of the Indian real estate market. While it offers significant growth potential, it also comes with risks tied to economic conditions and market trends. By staying updated with the latest stock price movements, analyzing market conditions, and evaluating the company’s financial health, investors can make informed decisions.

If you are planning to invest in IBREL shares, consider diversifying your portfolio to mitigate risks. Regularly monitor real estate news, government policies, and global